Why Rental Applications Get Denied - Key Reasons and Tips

Why Rental Applications Get Denied – Key Reasons and Tips

Finding a new place to live can be exciting, but getting denied for a rental application is frustrating. If you’ve ever wondered why this happens, I’ve got some key insights to help you avoid common pitfalls.

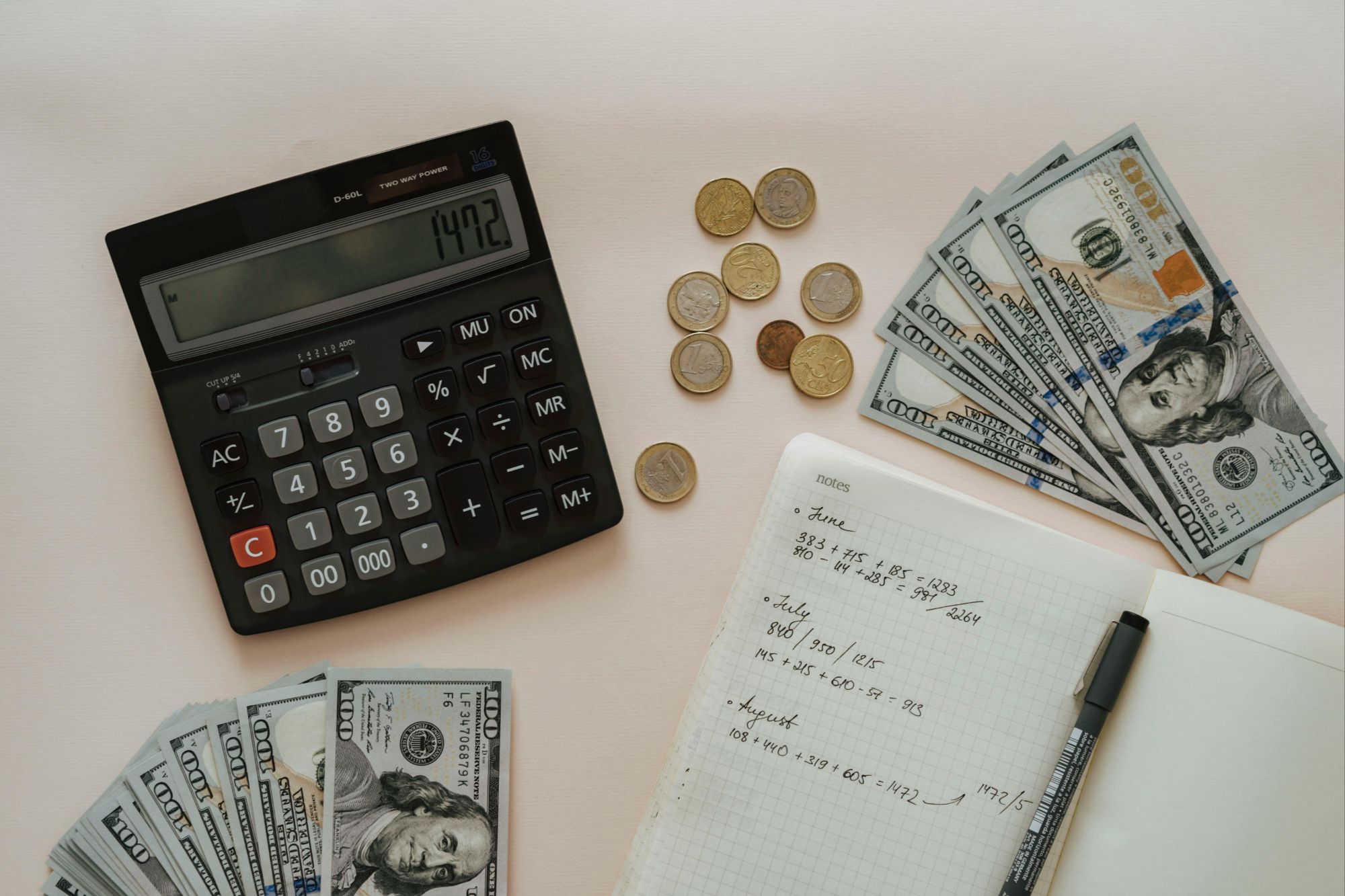

1. Credit Issues

One of the top reasons rental applications get denied is credit score problems. Many landlords and property managers use credit reports to assess financial responsibility. Here are two common scenarios that can lead to a denial:

- Low Credit Score – Even if you don’t have major debts, a score below 600 (or sometimes even higher) can hurt your chances. A score in the 400s or low 500s is often an automatic rejection.

- Outstanding Debt – If you owe a significant amount, especially to a bank, it raises red flags. Even with a decent score (650+), owing $10,000 or more could get you denied.

2. Unpaid Balances from Previous Rentals

If you have unpaid balances from past landlords or eviction records, that can be a dealbreaker. Many rental companies check for prior rental history, and an outstanding balance might mean an automatic denial.

3. Insufficient Income

Most landlords require tenants to earn at least 2.5 to 3 times the rent in monthly income. If your income doesn’t meet their standards, they may see you as a risk.

4. Background Check Issues

Some landlords also review background checks for past evictions, criminal records, or other red flags that may impact approval.

How to Improve Your Chances

- Check your credit before applying – Know your score and work on improving it if needed.

- Pay off outstanding debts – Prioritize rental-related balances and major financial obligations.

- Provide proof of stable income – Offer recent pay stubs or bank statements.

- Get a co-signer or larger deposit – If your credit isn’t great, this might help.

Final Thoughts

Getting approved for a rental takes preparation. Understanding the main reasons applications get denied can help you get ahead of potential issues and secure the home you want.

If you need help finding a rental or improving your credit, feel free to reach out!

Recent Posts

GET MORE INFORMATION